How Does Metamask Make Money? Details On Metamask Revenue Sources

By Daniel Asikpo Aug 05, 2024

Since the introduction of blockchain technology and cryptocurrencies we have seen several companies stepping in to become channels that promote free flow of this virtual asset.

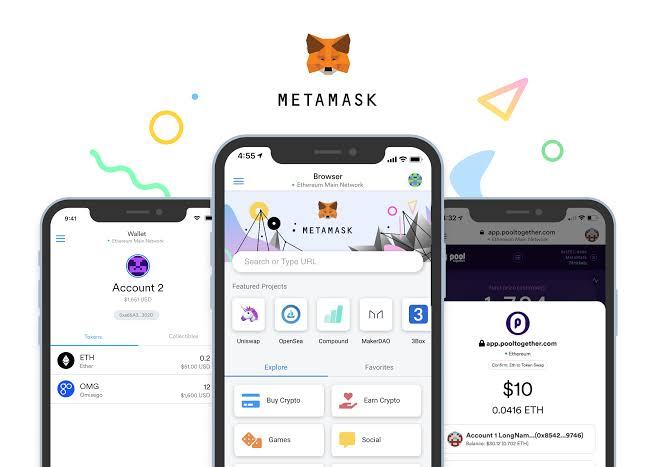

The increase in demand for wallets and blockchain gateway apps brought an opportunity for developers to leverage. They have without doubts been the needed aid to ease daily engagement in the cryptocurrency industry when thinking of buying, selling, storing, exchanging or swapping of these assets as the case may be. One of such pioneering wallets has been Metamask.

We have seen this cryptocurrency wallet grow in both apps and web extensions. How they stay in business is mostly what many overlook. There is a need to understand the metric of gains behind Metamask aside from the values it gives out to users. Sit tight, in this article we will break deeper into the revenue streams of Metamask, unveiling it's earning tentacles over their said years in business.

Metamask overview and milstones

As said, Metamask is a pioneering wallet on the Ethereum network that has helped promote a user-friendly blockchain environment for transactions and managing of digital assets. Adding to that, it opens up a platform for interactions with several decentralized applications(DApps) and also merges decentralized finance (defi) activities.

Metamask remains a subsidiary of ConsenSys, a blockchain technology company dated back to 2014 under Joseph Lubin. It later took its root inception in 2016 under Aaron Davis and Dan Finlay. While some say this company operates autonomously from its source, there is still without doubt a major cooperation.

It was first test-runned in 2016 as a browser extension which was incorporated into opera, chrome and firefox. There was a later introduction of support for ERC-20 (an ethereum-base token) in 2017 which featured token swaps. This was a needed stepping stone just a year after. The success moves continued to the succeeding year when Metamask in 2018 released their long awaited mobile app that supported iOS and Android.

With new users gaining ease of blockchain access, the introduction of easy staking feature in 2019 was a tactical move that saw a massive user participation as it allowed for both reward earning and blockchain validation. Talking of milestone achievement, in just four years of blockchain business, Metamask garnered over 1 million active users, something without doubt one must say is incredible.

The growth has been in a continuous rise. In January 2024, Metamask reported over 30 million active user achievements. Analysis shows this is a 55% increment from the preceding year. Nevertheless, it's all time high user engagement peaked in 2022 close to 31.7 million users.

We can attribute the user drops by then to unfavorable markets and platform competition as the case may be. Getting such user attention is very possible when we see the current figures. Why am I emphasizing more on this? Simple, we need to see the numbers so as to understand the revenue flow. In every business, numbers matter. When thinking half a cent is worth nothing, consider it when it's multiplied in millions.

If you ever imagined Metamask was a one sourced income corporation, you will have to rethink. As I earlier said, it has a lot to do with ConsenSys which is also known to spread tentacles into consulting and software development. We will be exploring the five most feasible sources pairing them with the current user base. Also in the process, looking at its revenue generation in fiat as of 2020 till date. Another thing to consider is that the blockchain industry is still in its growing phase. This also raises a question of what the future holds for Metamask and other related cryptocurrency wallets.

Metamask revenue generating channels

● Gas fees

If you are a regular user of the Ethereum network then you would probably be aware of how the ecosystem is operated. Gas fees play a huge role in a blockchain ecosystem as a whole when looking at a need for a secure, sustainable and efficient network. In the absence of gas fees especially in the Ethereum network, there would have been a rise in vulnerabilities.

Malicious actors have in the process been prevented from overcrowding the chain with irrelavant transactions. The main idea centering gas fees was for validator tipping. Nevertheless, not the entire percentage is attributed to validators. This is where Metamask steps in to benefit from it.

Did you know Metamask charges 0.875% per transaction? This entails the base fees(burned), priority fees (validator incentives) and the unit of gas usage. Mathematically, this is how it looks; base fees + priority fees x unit of gas. So why are these charges high? That's how to stack transactions and get them out, instead of first in priorities it focuses more on the highest bidder transaction model if I should say. The simplest explanation is this, assuming you were to get to a destination that is a mile walk, what would you do? Of Course you can choose to walk( increasing your waiting time) or you can board a vehicle(pay validators to save time).

● Swap fees

Unlike gas fees which center on external transaction cost, the swap fees are charges of transactions within the Metamask platform. The swap features makes it possible for users to toggle between two crypto assets as they pay some transactional incentives in the process. In the Metamask ecosystem, swap fees have an in feature of fixed fee, liquidity provider fee and price impact.

The fixed fee entails the percentage amount(usually very little) charge for every swap. Added to that is the liquidity provider fees which is used to reward blockchain liquidity providers who facilitate each swap. The price impact needs to be calculated out in the process, it's more of avoiding a landing price above expected transportation.

● Metamask Premium services

Asset security remains top priorities for huge asset holders in the Metamask ecosystem. The introduction of premium service has helped to improve the features and asset management experience. Some premium features include an increase in transaction limits, quick response customer care, advanced security features(account backup and multifactorial authentication).

Although unable to get the exact figures of their premium subscribers, pondering upon over 30 million active users, one would say a significant sum is expected.

● Metamask Partnership and integration program

Just as earlier said, there is a fair advantage this company generates from ConsenSys. The blockchain ecosystem is an interconnection of service providers and developers who gain financial benefits from every collaboration.

We should understand that this company has garnered a lot of blockchain influence, which has helped to drive sponsors and investors to their direction. It has an integration with over 17,000 web3 apps and protocols. We can from here say it serves as a hub for numerous web3 services. Some partnering companies include; NFT platforms, Linea, Infura, and Robinhood connects.

● Staking rewards

Metamask's staking for reward feature was introduced in 2019 and it has really impacted their revenue generating streams. When users get involved in blockchain validation processes to earn rewards, these also in the process convert a percentage to profit this company. This has also helped to add value to their defi ecosystem.

Revenue rundown from 2020 to 2024

The outpour of Metamask success really surfaced four years after its inception. After the introduction of the staking for reward feature in 2019, it was followed by a $10 million revenue report in 2020. As the users continued to find value from their services, there was a 500% revenue surge the succeeding year.

This kept their revenue position at $50 million dollars before rounding up 2021. We could recall that 2021 was mostly a season in which decentralized finance (defi) got attention and it indeed turned out to announce Metamask. The growth doubled up yet again in 2022 when revenue was reported to reach $100 million. As we speak, several sources report this company to be soaring with over $250 million in revenue. This we are yet to ascertain as we have not yet laid hands on 2023 and 2024 yearly revenue reports.

The Bottom Line

The cryptocurrency industry is on a continuous growth and one of its full time beneficiaries has been Metamask. Creating a platform for cryptocurrency transactions with more pursuit for web3 incorporation will continue to skyrocket this company. As I earlier said, numbers matter and in a flexible environment like the internet, it will also be a good place to leverage when you provide just the right service.

Disclaimer: The content on this page and all pages of Icoverage.io are presented for informational purposes only and should not be considered finance or legal advice.

This page may contain affiliate promotions, see our affiliate disclosure to learn more.

Informations published are not financial advice see our terms of service

We use diverse first and third party softwares on our website, see our privacy-policy

If you found an error, misinformation, or something harmful or unusual on this page please report it now!

This page or pages of this website may contain affiliate links that earn us commissions when you use them at no additional cost to you, see our affiliate disclosure.

© ICPF All Rights Reserved

.gif?ts=1751890095)