Spot Bitcoin ETFs AUM hits $148.67bn as Grayscale files confidential IPO

By Reel Coverage Jul 17, 2025

Spot Bitcoin ETF issuers reached $148.67 billion in assets under management (AUM) on July 17, two days after reports of Grayscale’s confidential IPO filing.

Spot Bitcoin exchange traded funds (ETFs) debuted on January 11, 2024 and have since attracted over $87.12bn in investments, as suggested by data on net monthly inflows at $4.84bn.

That said, Spot Bitcoin ETFs assets under management (AUM) has grown to $148.67bn, for the first time as Bitcoin price grows by over 80% in the last year.

On July 17, 2025, Spot Bitcoin ETFs assets under management (AUM) surged to a valuation of $148.67bn, just two days after Bitcoin hit a new all-time high (ATH) of $123,091.61.

Spot Bitcoin ETFs AUM: $148.67bn

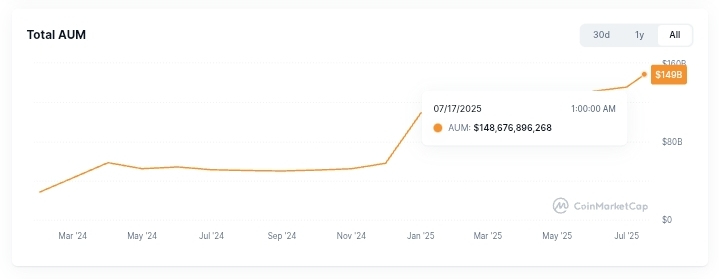

Spot Bitcoin ETFs assets under management (AUM) | Data: Coinmarketcap.com

Spot Bitcoin ETFs assets under management grew by approximately $13 billion (bn) between July 01 and July 16, reaching $146,676,896,268 or approximately $146.67 billion (bn) from $135,670,601,508 or approximately $135.67 billion (bn).

As seen in the chart above, this surge marks the second largest AUM growth within the shortest timeframe since December, 2024, partly driven by Bitcoin’s recent price growth which saw the largest crypto asset by market capitalization hit a new all-time high of $123,091.61.

Spot Bitcoin ETFs assets under management (AUM) as a percentage of Bitcoin's market capitalization | Data: Coinmarketcap.com

While Spot Bitcoin ETFs assets under management (AUM) grew by approximately $13 billion, representing a 9.58% growth, the instruments’ position as a percentage of Bitcoin's market capitalization has fallen by 0.10% to 6.30% from 6.40% as of yesterday, July 16.

While not a significant change as it remains 0.30% above its 6.00% rate as of July 14, current AUM as a percentage of Bitcoin's market capitalization highlights a small inverse movement in bitcoin market price and Spot Bitcoin ETFs assets under management (AUM) in the last 24hrs.

Grayscale files confidential IPO

On Monday, July 14, 2025, Grayscale, a leading Crypto-focused asset manager, disclosed confidentially submitting paperwork with the Securities and Exchange Commission, signaling potential plans for a U.S. listing, according to a Reuters report.

Grayscale is the second largest Spot Bitcoin ETF issuer with over $21.88bn in assets under management (AUM), according to data from Coinmarketcap.com.

Grayscale’s move for initial public offering (IPO) was met with enthusiasm amongst crypto investors with speculation of higher capital flexibility for further expansion of ETF offerings as reports surfaced.

Grayscale’s IPO could enable the crypto asset manager to tap into new funding opportunities such as public stock offerings, popularly leveraged by Michael Saylor’s Strategy and/or convertible note offerings.

With Spot Bitcoin ETFs best performing period by net inflow being 8 months back, precisely in November, 2024, which saw $6.61B net inflow into Spot Bitcoin ETFs according to data from Coinmarketcap.com, Grayscale’s IPO could serve as a catalyst for stronger inflows in 2025.

.gif?ts=1752831442)