The State Of Consumer Crypto Apps And The Fate Of Mass Adoption

By Immutable Gospel Aug 17, 2024 Research/Opinion

While there is a widespread desire for mass consumer crypto adoption, few are developing applications suitable for said market.

This comprehensive article provides an in-depth analysis of the current state of consumer crypto apps, highlighting their successes and challenges, with recommendations to enhance the ecosystem for vast consumer adoption.

At A Glance

● Consumer crypto apps are crucial for achieving mass adoption.

● The demand for consumer crypto apps is expected to increase as trust in traditional systems declines.

● Current consumer crypto apps present high entry barriers, limiting their adoption.

● Fee-less blockchain networks are poised to be a significant driver of successful consumer crypto apps.

● Stablecoins represent a consumer product that has yet to be fully maximized.

Understanding Consumer Crypto Apps

What are consumer crypto apps?

Consumer crypto apps are simply crypto-powered applications designed specifically for everyday users rather than businesses or organizations.

These applications offer a range of services, including social media platforms, savings or investment products, streaming services, and games. What distinguishes them as "consumer apps" is the focus on creating unique and tailored experiences for individual users.

With approximately 560 million cryptocurrency users worldwide out of a global population exceeding 8 billion, there's a huge consumer market that is yet to be on-boarded onto the world of cryptocurrency and blockchain technology.

As of 2024, the total funding for cryptocurrency and blockchain-related projects has exceeded $90 billion. In 2024 alone, crypto projects received approximately $3.67 billion across 604 funding rounds.

The majority of this funding, about $1.74 billion, has been directed towards infrastructure projects, with relatively little allocated to consumer applications. This indicates a significantly neglected market for consumer crypto apps.

That said, emerging ecosystems like the TON blockchain are discovering this underexplored value network and have made calculated steps to invest over $40 million in crypto projects focusing upon building consumer solutions.

Deep Dive Into Top Consumer Crypto Apps

Categorized by sector, here are insights into the top consumer crypto apps making an impact. Before delving into the list, it is important to understand what qualifies as a consumer app in the crypto space.

Many crypto enthusiasts often think of popular services with high Total Value Locked (TVL) when considering consumer crypto apps. While these applications do "serve users" in some capacity, they are generally more suitable for individuals already familiar with blockchain technology and its relationship with crypto assets. These users often have a background in or knowledge of programming or a similar skill set.

In contrast, the average consumer is not typically experienced in technological fields. Therefore, services or products that require technical know-how will face significant limitations in achieving widespread adoption among consumers.

With this in mind, our list of "top consumer crypto apps" includes a combination of applications that truly understand their target market—consumers—and design their services accordingly, as well as other popular crypto-native apps. Each category features only the top two performing applications on average.

● Wallets

As the primary gateway to all things crypto and blockchain technology, wallet applications serve as the starting point for many consumers looking to enter the world of decentralized finance and immutable data management systems. With that in mind, let's explore the top consumer crypto wallet applications and evaluate their strengths and weaknesses in serving the consumer market.

- Metamask

With over 100 million users, including an estimated 30 million active users, Metamask is undoubtedly one of the most widely used "crypto-native" applications. Primarily serving the Ethereum ecosystem, Metamask is one of the oldest non-custodial wallets and has significantly benefited from being a default integration for emerging crypto projects, enabling users to pay or subscribe to services directly via a self-managed wallet.

Metamask falls into the category of applications built for users with some crypto knowledge. This is evident from its sign-up flow, which heavily emphasizes the underlying blockchain technology. Such an approach can make users who are entirely new to crypto feel ill-equipped and overwhelmed.

As a browser extension and mobile application, Metamask allows users to store ERC-20 assets and interact with various Ethereum-based applications. Its viral growth can be attributed to its compatibility with numerous frameworks, such as browsers, and its status as one of the early non-custodial wallet options in the crypto space, earning the favor of developers.

However, despite its popularity among developers, Metamask is not necessarily the best option for average consumers. To improve its appeal, Metamask needs to enhance its sign-up process, ensure the app is more lightweight, and refine its overall interface for easier usability.

- Phantom

Phantom is a non-custodial wallet serving the Solana blockchain, allowing users to buy, store, and trade fungible tokens like SOL and NFTs launched on the Solana blockchain. Phantom stands out as one of the top Solana-native wallet applications and is widely recognized for its consumer-friendly approach.

With over 7 million users, Phantom provides easy access to products and services built on the Solana blockchain. It is not only user-friendly within the Solana ecosystem but also serves as an accessible entry point to the broader crypto space. Phantom supports Ethereum and Polygon-based assets while primarily facilitating the adoption of Solana, a blockchain built for high transaction speed and throughput through its Proof-of-History (PoH) mechanism.

One of the key features that make Phantom stand out as a consumer-friendly wallet is its intuitive sign-up flow and easy-to-navigate user interface. Despite the presence of common crypto and blockchain terms like "wallets" and "seeds," users can create a wallet and interact with the Solana ecosystem with just a few clicks.

Phantom's lightweight and easy-to-use framework contribute to its viral growth. With the rising popularity of meme coin trading on Solana, Phantom has positioned itself as the default wallet application for users interested in this trend.

However, there is room for improvement. One much-needed feature is multiple wallet backup solutions within the app. Although Phantom emphasizes user privacy by not requiring private information like email addresses and phone numbers, many consumers would be willing to provide this data if it enhanced the security of their wallet and the safety of their assets.

- Argent

Argent is a non-custodial mobile wallet and extension designed for the Ethereum layer 2 blockchain, Starknet. With a self-reported user base exceeding 2 million, Argent has established itself as a leading consumer application within the layer 2 ecosystem.

Similar to Phantom on the Solana blockchain, Argent offers a user-friendly sign-up process and an intuitive interface. However, Argent distinguishes itself by eliminating the need for users to manually store seed phrases. Instead, it integrates with Google Drive for encrypted automatic backups, a feature that, while not essential for seasoned crypto investors, is likely to be highly valued by the broader consumer base.

Despite these advantages, Argent faces challenges due to its viral growth strategy, which has also become a significant vulnerability. During the Starknet airdrop, Argent, like other wallets, was widely used by users seeking to increase their trade and transaction volumes in pursuit of the airdrop. The airdrop’s release was met with criticism, as it was deemed “unfair” by many in the community, leading to a sharp decline in Starknet’s active user base. Daily active addresses plummeted from 100,000 to 20,000 post-airdrop, with current averages hovering between 7,000 and 5,000.

The monthly transaction count also saw a significant decrease, falling from over 20 million at its peak to 1.1 million, indicating a substantial exodus of users from the network. This decline in Starknet participation poses a challenge for dedicated chain wallet software like Argent, casting uncertainty over its future growth prospects.

● DeFi

- MakerDAO(DAI)

MakerDAO is a leading Decentralized Autonomous Organization (DAO) that manages the third-largest stablecoin by market capitalization. It operates the most decentralized stablecoin on the Ethereum blockchain.

MakerDAO's product suite includes decentralized lending, savings, and borrowing services, anchored by its over-collateralized stablecoin, DAI. Over-collateralization means that borrowers must lock up assets worth more than the amount of DAI they borrow, ensuring that DAI remains stable and pegged to the USD, backed by real asset reserves.

Since its inception in 2015 and the launch of DAI in December 2017, MakerDAO has leveraged its early entry into the stablecoin market to become a dominant player in decentralized finance (DeFi). By offering a secure and stable solution without centralized management, MakerDAO has attracted significant industry interest and captured a substantial share of the decentralized lending and borrowing markets.

Is DAI a consumer product? As a stablecoin that can be spent, saved, and borrowed against, DAI is indeed in high demand. However, it faces two significant challenges: operating on Ethereum, which has recently struggled with high transaction fees, and the lack of a mobile application that would facilitate easy sign-up and savings on a decentralized platform, limiting its broader consumer appeal.

Nevertheless, MakerDAO, through its community-developed lending protocol, Spark, offers a feature of great value to consumers: the "Sandbox." This feature functions like a "demo trading account," allowing users to explore and learn about the system or application before fully engaging with it. Given that the average consumer may not be deeply versed in crypto or blockchain technology, this tool is an invaluable resource for helping users navigate and maximize their use of DAI.

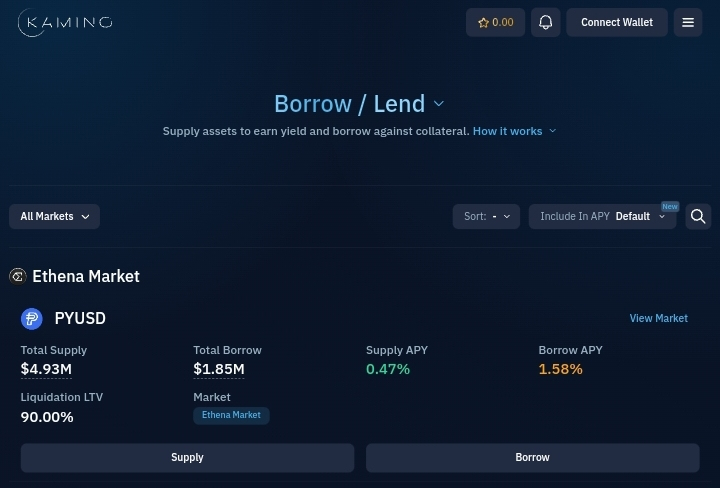

- Kamino Finance

Kamino Finance is a Solana-based DeFi protocol offering a comprehensive suite of services, including lending, borrowing, liquidity mining, and leveraged trading.

With over $1.3 billion in Total Value Locked (TVL), as reported by Defillama.com, Kamino is currently the largest DeFi platform on the Solana network.

One of Kamino’s primary challenges is its user interface (UI), which is less consumer-friendly compared to other Solana-based applications known for their efficient and responsive UIs. The platform's software can be cumbersome, affecting load and response times.

However, Kamino does provide a variety of sign-up options, including traditional services like Google, which is widely adopted by consumers. Despite these conveniences, like many DeFi applications, Kamino's product offerings require a moderate level of cryptocurrency knowledge, which may present a learning curve for some users.

- Evaa Protocol

Evaa Protocol is a decentralized lending platform built on the TON blockchain, boasting over 400,000 users and a Total Value Locked (TVL) exceeding $35 million, according to data from Defillama.com.

The platform reports that over $27 million has been borrowed through the protocol, with more than $63 million supplied by lenders. Evaa Protocol’s growth is driven by its integration with Telegram as a Mini-app, making it easily accessible to users. The platform’s user-friendly Mini-app design and overall UI contribute to its popularity, with over 28,000 monthly Mini-app users and 12,000 active on-chain users.

Thanks to Telegram's integrated blockchain wallet, signing up for Evaa Protocol is a seamless experience, unless users choose to connect external non-custodial wallets like TON Keeper.

However, one feature that could further enhance the user experience on Evaa Protocol would be the addition of a built-in function that allows new users without a token balance to quickly acquire or purchase tokens. This could be facilitated through Telegram’s payment currency, Stars, or direct card payments via Google or Apple Pay.

● Social

The social consumer crypto industry, which captures a significant amount of consumer attention, is seeing various applications vying for a large network of users who are actively searching for the next engaging community or content. Below is an overview of active social applications powered by crypto and blockchain technology.

- Lens

Currently operating on Polygon’s Proof of Stake (PoS) blockchain, with plans to expand to zkSync, the Lens Protocol is a permissionless social graph designed to ensure true content ownership and control, promoting an inclusive creator economy.

The Lens Protocol powers various "web3 social frontends" such as Hey (formerly Lenster), Tube, Orb, Mask, Firefly, T2, and Phaver. These platforms are decentralized and permissionless, enabling the creation and distribution of text, audio, and video content across decentralized file storage systems like Arweave.

While Lens Protocol allows these social frontends to host textual data on an immutable layer, the frontends still retain the authority to ban or restrict accounts according to their terms of service and usage rules. This aspect positions Lens-based social networks closer to a web2.5 platform than a true web3 platform. Despite the immutability of data passed to the protocol, frontends still control content distribution.

Lens Protocol’s viral growth can be attributed to its development by Aave, a leading decentralized lending and borrowing platform with over $21.1 billion in assets locked across 8 blockchains and 15 markets. However, Lens-based social platforms face a significant limitation compared to competitors like Facebook: the requirement of an 8 Matic token fee (approximately $3.20 at the time of writing) to create a Lens handle. This fee is intended to combat bots and support the project’s scalability, but it could also hinder broader user adoption.

- Mirror

Mirror is a web3 alternative to Medium, designed to enable creators to fully own their content and monetize it through NFTs.

To publish on Mirror, users must connect an EVM-compatible wallet and switch to the Optimism network. What sets Mirror apart is its unique approach to social platforms powered by crypto and blockchain technology.

There are no barriers to entry for signing up on Mirror, and posting is also frictionless and free. Additionally, Mirror allows creators to monetize their content by converting articles into collectibles or NFTs that readers can mint or collect. Creators have full control over the mint price and the supply of NFTs, and they receive a portion of the fees paid for minting.

Earlier this year, Mirror was acquired by Paragraph, a competitor in the Web3 social media space. Although Paragraph offers more features and greater customizability, Mirror’s simplicity and clean user interface make it a more consumer-friendly option.

With an estimated 10,000 creators, Mirror is not yet a dominant player in the creator market but remains a unique, decentralized, and streamlined alternative to Medium.

- Hive

Hive is a delegated Proof-of-Stake (DPoS) blockchain featuring an integrated social layer that rewards content creators and incentivizes developers to build web3 communities on a decentralized and immutable infrastructure.

Hive originated as a community-driven response to the censorship takeover of Steemit, a web3 social platform initially created for the purposes now served by the Hive ecosystem. As a result, Hive launched its own chain to maintain its commitment to decentralization and free expression.

Popular social frontends on Hive, such as Peakd.com and InLeo.io, attract thousands of active creators and content consumers. Peakd primarily focuses on long-form content similar to Medium, while InLeo offers a mix of microblogging and long-form content, positioning itself as a major communication hub for crypto and blockchain projects, rivaling platforms like X (formerly Twitter).

Hive’s tokenized social layer allows both creators and curators (readers with a stake) to earn rewards. Curators are entitled to a share of the Hive reward pool, which is distributed based on the amount of Hive staked and the posts they vote on. Rewards are split 50/50 between the curator and the creator, with millions of dollars earned by participants annually. For instance, a report from January 2023 indicated that Hive creators and curators collectively earned $6,344,255 that year.

As a blockchain with no transaction fees, Hive enables its social dApps to scale easily, allowing for seamless sign-ups and onboarding of thousands of users without the need for account creation fees.

However, Hive's growth is hindered by a lack of significant marketing initiatives, limiting its broader adoption. Unlike other web3 social platforms, Hive offers user-friendly handles that are easily readable and also serve as payment addresses on the blockchain. All data posted through these accounts is stored on-chain and is publicly viewable.

● Gaming

Blockchain games are typically not fully integrated on-chain due to the complexities of game development. Instead, they are often governed or powered by a token economy tied to a specific blockchain network.

In recent years, there has been a noticeable decline in interest in blockchain games built on networks like Ethereum, primarily due to high entry barriers. For instance, Axie Infinity, the most popular blockchain game of 2021, reached a peak of 2.7 million monthly players but now averages just over 300,000. A significant factor in this decline was the high entry cost, which reached as much as $400 in 2020.

However, new trends in "mini app" games with free or low-cost entry, such as Notcoin, Catizen, and Hamster Kombat— all built on the TON ecosystem—are beginning to reshape the landscape. Hamster Kombat, in particular, has garnered significant attention, reportedly attracting over 300 million players. According to Telegram's public statistics, over 155 million people actively use the mini app each month.

Telegram-based games are emerging as effective consumer applications by offering engaging experiences through a combination of "edutainment" and crypto incentives, lowering the barriers to entry and driving greater user adoption.

● Other

- Dmail

Dmail Network utilizes an AI-powered decentralized communication infrastructure designed to provide encrypted emails, unified notifications, and targeted marketing across multiple blockchain networks and decentralized applications (dApps) for users, developers, and marketers.

With over 249.27 million messages exchanged, 150.05 million on-chain transactions, 3.11 million NFT domains minted, and more than 16.13 million self-reported users, Dmail has become not only the largest blockchain-based messaging service but also one of the largest crypto consumer apps, deeply integrated with crypto and decentralized infrastructures.

Dmail offers crypto users a secure and private way to connect and share information using their blockchain addresses. Its viral growth can be attributed to its airdrop campaigns and internal points system, which incentivize users to complete tasks on the platform in exchange for points that can be used across various services within the messaging ecosystem.

Dmail stands out as a unique consumer app, offering traditional-grade email services while heavily integrated with blockchain technology. It successfully bridges the value of both traditional and decentralized worlds. However, its growth potential is somewhat limited by the low penetration of crypto-powered consumer services, as general appeal in the broader market remains modest.

- Audius

Audius is a blockchain-powered music streaming service that integrates the security and flexibility of Ethereum with the distributed file storage capabilities of the InterPlanetary File System (IPFS).

IPFS is a protocol and peer-to-peer network that enables decentralized file storage and sharing. Unlike traditional centralized systems where data is stored on a single server or a cluster of servers managed by one entity, IPFS allows files to be stored across a distributed network of nodes. This decentralized approach enhances security and ensures that content is less vulnerable to censorship or single points of failure.

Audius leverages this combination of Ethereum and IPFS to not only distribute music but also to create an incentivized connection layer for thousands of artists and over 3.6 million users. With more than 287 million monthly plays, Audius stands as a blockchain-powered alternative to popular music streaming services like Spotify, making it one of the most highly engaged consumer crypto apps.

In the broader landscape, consumer crypto apps built on Ethereum dominate in terms of user adoption and value flow. While Ethereum-based platforms lead the way, other blockchains like Solana, despite offering higher throughput, better user interfaces, lower fees, and reduced friction, have yet to see top-performing consumer services. The current state of consumer crypto apps favors Ethereum, but there are significant opportunities for blockchains like Solana, Hive, and TON to capitalize on and expand their presence in the market.

Why We Kept Out Exchangers On Consumer Crypto Apps List

Exchanges, whether decentralized like Uniswap or centralized like Binance, are well-known and widely used applications in the crypto space. However, these services are better understood as "third-wheel" applications rather than primary consumer apps. To achieve large-scale penetration in the consumer market, crypto services and products need to be integrated into gateway applications such as wallets, social platforms, or games.

The design of most decentralized exchanges (DEXs) is a clear indication that these applications are primarily aimed at crypto-native users, rather than new consumers with little to no blockchain knowledge. This focus on the technically proficient limits their broader appeal and adoption among the general public.

In contrast, projects like Notcoin within the TON ecosystem have successfully onboarded millions of users from Telegram onto the TON blockchain. This success highlights that the broader consumer network is less concerned with the advanced technical aspects of crypto and more interested in simple, intuitive concepts that allow them to easily consume and extract value from the system.

Building on the success of Notcoin, the TON ecosystem has strategically moved to further penetrate the consumer market by launching "TON Ventures." With $40 million raised to invest in early-stage consumer applications within the TON ecosystem, the focus is on developing products with "mass appeal" that can attract and retain a wider audience beyond the crypto-savvy.

The Role Of Fee-less Blockchains In Scaling Consumer Crypto Apps

The scalability and widespread adoption of consumer crypto applications are heavily influenced by transaction costs and overall user experience. Traditional blockchains like Bitcoin and Ethereum have been criticized for high transaction fees and latency, which can be significant barriers to everyday consumer use. Fee-less blockchains offer an innovative solution to these issues, making them a vital component in the scaling of consumer crypto applications.

A noteworthy example of the potential for "fee-less" blockchains to drive user adoption is the Delegated Proof-of-Stake (DPoS) blockchain, Hive. Hive operates on a gas-free model, utilizing Resource Credits (RCs), a virtual, non-tradable gas token linked to staked Hive.

Users receive RCs in proportion to the amount of Hive they have staked. These credits are consumed during transactions but do not incur real-time costs to the user. This system effectively eliminates traditional transaction fees, ensuring a smoother and more predictable user experience. As RCs replenish over time, users are incentivized to stake Hive, which bolsters the network's stability and security. This design not only enhances the user experience by removing the unpredictability of transaction costs but also encourages long-term engagement with the network.

To illustrate this mechanism, consider the following example:

If a user purchases and stakes 100 Hive tokens, they are allocated several billion credits known as RCs. Each transaction on the blockchain consumes a portion of these credits. The more transactions a user processes, the more credits are depleted. However, these credits gradually replenish over time. Depending on the volume of transactions, the replenishment period can range from a few minutes to several hours, allowing the user to continue transacting without interruption.

Importantly, these credits do not reduce the user’s staked Hive, effectively making the blockchain "fee-less."

Is this approach consumer-friendly? Based on personal testing, an account with no Hive staked can perform approximately 25 transactions on the blockchain before needing to wait for credit replenishment or to purchase and stake additional Hive. With 100 Hive staked, the average user can conduct hundreds of transactions daily. The amount of RCs consumed varies depending on the type of transaction. For instance, textual transactions typically require more resources than simple token transfers on this blockchain, which supports gaming applications and social platforms.

The effectiveness of this design is evident in the active social networks on the Hive blockchain, such as Peakd and INLEO, which attract tens of thousands of monthly users.

The RC to staked Hive ratio is determined by the blockchain's witnesses, who are elected by Hive stakeholders.

Memecoins And Prediction Markets As A Consumer Crypto Product

Memecoins have swiftly gained popularity as a consumer product, appealing to the human tendencies towards gambling and speculation. Their allure is rooted in their unpredictable and often volatile market behavior, which mimics the thrill-seeking elements of gambling. This phenomenon mirrors the global betting industry's immense scale, with estimates indicating that the global gambling market is worth $500 billion annually.

Platforms like Pump.fun have successfully capitalized on this trend, providing a venue for the launch and trade of new memecoins. In July 2024, Pump.fun achieved a record $28.7 million in monthly revenue, driven by increased retail interest and endorsements from celebrities like Caitlyn Jenner and Iggy Azalea.

The gambling-like nature of memecoins leverages the inherent excitement of betting on uncertain outcomes, much like traditional gambling industries. With aforementioned betting market valuation, the potential for growth in the memecoin sector within the crypto space is substantial. This trend aligns with the broader move towards speculative trading, where users seek out high-risk, high-reward opportunities.

In contrast, prediction markets like Polymarket offer a more structured approach to speculative investment, allowing users to wager on the outcomes of future events. These platforms operate on the principle that collective intelligence can produce more accurate predictions than individual experts. Polymarket, built on the Polygon network, has emerged as a leader in this space, enabling users to trade on a wide range of events, from political elections to entertainment outcomes.

Polymarket has seen significant user engagement, with over $592 million wagered on the 2024 US presidential election alone. This level of activity underscores the platform's ability to attract a diverse user base eager to leverage their knowledge and insights for profit.

Why Now Is A Great Time To Build Consumer Crypto Apps

The cryptocurrency ecosystem has experienced rapid technological advancements, each contributing essential elements to the development of consumer-friendly crypto applications. To fully appreciate the progress that has been made, it is important to review key events from past years and compare them to recent developments. This comparison will highlight how far the industry has come and the new opportunities that have emerged as a result.

● Safety And Reliability Of Cryptocurrencies

To begin, a 2023 survey revealed that 75% of Americans lacked confidence in the safety and reliability of cryptocurrency—a concern that was not unfounded given that over $3.7 billion was stolen from crypto users in platform hacks the previous year.

However, this figure has since been reduced by half, thanks to several technological advancements that have been implemented in blockchain projects.

For instance, in July 2024, Chainlink introduced what it calls the only interoperability protocol with level-5 security. Historically, many of the largest hacks in the crypto space have been linked to vulnerabilities in smart contracts and token bridges.

Token bridges facilitate the transfer of specific tokens or assets between different blockchains, functioning similarly to multi-platform bank transfers. These bridges act as a central network, receiving assets from one blockchain and crediting the intended recipients on another. They operate through smart contracts—autonomous code that executes predefined actions.

Chainlink’s Cross-Chain Interoperability Protocol (CCIP), now available on networks such as Avalanche, Ethereum, Optimism, and Polygon, introduces an advanced security framework. This innovation enables developers and businesses to build more secure "value transfer systems," addressing the vulnerabilities that have plagued the industry in the past.

“

CCIP is the most secure, reliable, and easy-to-use interoperability protocol for building cross-chain applications and services. Not only are developers given the flexibility to build their own cross-chain solutions on top of CCIP using Arbitrary Messaging, but CCIP also provides Simplified Token Transfers—which enables protocols to quickly start transferring tokens across chains using audited token pool contracts they control without writing custom code and in a fraction of the time it would take to build on their own.

”

Leveraging its Oracle network, which already secures and facilitates over $12 trillion in on-chain transaction value, Chainlink's Cross-Chain Interoperability Protocol (CCIP) operates on a robust stack of cross-chain solutions. These include customizable rate limits on token transfers and a Risk Management Network designed to verify the validity of all cross-chain transactions.

Additionally, Chainlink's CCIP introduces the concept of "programmable token transfers." This innovation allows tokens to carry custom instructions that dictate their intended use when interacting with a receiving smart contract on a different blockchain. By automating specific actions and streamlining the value transfer process, CCIP significantly reduces the time required for transactions to reach finality, making cross-chain operations more efficient and secure.

● Volatility and Financial Risk

Beyond concerns about the safety and reliability of cryptocurrencies, many potential users are also deterred by the high volatility of these assets. This unpredictability can lead to significant financial losses, creating a substantial barrier to widespread adoption.

The impact of cryptocurrency volatility has been particularly pronounced in the decentralized finance (DeFi) sector, where investors, especially liquidity providers, have faced substantial asset-side and value losses. However, significant technological advancements have been made to mitigate some of these challenges.

One such innovation is the development of "Concentrated Liquidity," which allows liquidity providers to set custom price ranges for the liquidity they supply to a pool. This capability helps reduce asset-side losses and enables providers to maximize returns by targeting specific market trends.

Additionally, the rise of stablecoins has offered a stable alternative to more volatile crypto assets like Bitcoin and Ethereum. In countries facing severe economic challenges, such as Nigeria and Venezuela, where hyperinflation is a pressing issue, stablecoins present an attractive store of value that remains insulated from the economic instability of these nations.

The growing availability of savings options for stablecoins also provides a unique opportunity for individuals to increase their income or wealth on a permissionless network. This opens up a significant market of consumers who are actively seeking sustainable financial solutions to hedge against the devaluation of their native currencies, presenting developers with a broad and engaged user base.

● Regulatory/Legal Uncertainty And Lack Of Understanding

The perceived lack of clear and consistent regulations within the cryptocurrency industry has been a significant obstacle to its widespread adoption.

Additionally, limited public understanding of what cryptocurrencies are and how they function has deterred many from investing. A survey highlighted in a Cointelegraph report found that 42% of respondents admitted they did not understand the value or operation of cryptocurrencies, which has prevented them from entering the market.

However, both of these issues have garnered substantial attention in recent years. To address the knowledge gap, there have been numerous initiatives focused on educating and onboarding individuals into the crypto space. These efforts include a wide array of resources designed in "easy-to-understand" language, making it easier for newcomers to quickly acquire fundamental crypto knowledge and navigate the sector with confidence.

Regarding regulatory uncertainty, there have been significant developments that suggest a shift toward greater clarity. The involvement of major financial institutions, such as BlackRock, which launched the iShares Bitcoin Trust (IBIT) on January 11, 2024, has played a crucial role in this shift.

The ETF has since attracted over $19 billion in investments, signaling growing institutional confidence in the cryptocurrency market. Moreover, proposals in the U.S. to establish Bitcoin as a strategic reserve asset indicate that regulatory uncertainty is gradually diminishing. This increased government and institutional interest in crypto is not only fostering a more stable regulatory environment but also generating global awareness of blockchain-powered assets.

Scaling To 1 Billion Users - What Is Missing With Consumer Crypto Apps For Explosive Growth

The crypto ecosystem, with its vast array of products and services, naturally attracts consumers with diverse needs and interests. However, this diversity also means that there are multiple challenges to address when it comes to developing consumer-friendly crypto applications.

For instance, many blockchain-based social media platforms face usability issues due to transaction fees. While platforms like Hive can bypass these fees, they encounter a different challenge: an onboarding process that demands a certain level of crypto and blockchain knowledge from new users.

To scale to a billion users, consumer crypto applications will need to integrate soft-distributed crypto education within their platforms, allowing users to learn as they engage with the app daily. It’s crucial that the sign-up process for these apps is as simple as traditional web2 applications while preserving the decentralized nature and security inherent in web3 frameworks.

The less friction these applications present, the greater their potential to attract a large user base. It's also important to recognize that many current crypto apps, often labeled as "consumer apps," are primarily targeted at the investing population. However, true "consumer apps" are about usage, not investment.

This is where products like decentralized stablecoins can play a critical role in scaling crypto to a broader consumer base. The average consumer typically engages in three primary activities: using free services, saving money, and spending money.

A prime example of using free services is the vast network of users on Facebook, which has attracted billions of people due to its low-friction user experience. To bring similar numbers to blockchain-based social applications, these apps will need to eliminate fees and streamline their sign-up processes.

When it comes to saving and spending money, stablecoins offer a compelling solution. With billions of consumers in countries impacted by inflation, a consumer crypto app that provides frictionless savings and spending options could significantly ease everyday transactions. Such an app would allow users to access borderless payments and user-friendly savings solutions, making it easier for them to manage their finances in a stable, decentralized environment.

Given that consumers are more focused on usability than investment, fee-less blockchains would provide an ideal foundation for savings and spending-focused consumer crypto apps. By eliminating transaction fees, these blockchains can help ensure that users feel they are getting more value for their money, thereby enhancing their overall experience and satisfaction.

An Inflation-proof Stablecoin As An In-demand Consumer Solution

Inflation remains a global plague with projections indicating that inflation will stay above pre-pandemic levels for the foreseeable future. The International Monetary Fund (IMF) forecasts global inflation to be 6.6% in 2023 and 4.3% in 2024, showing a gradual decline but still higher than the historical average.

Major economies like the United States and the European Union are grappling with inflationary pressures, while countries like Zimbabwe and Venezuela face hyperinflation with rates surpassing 200%.

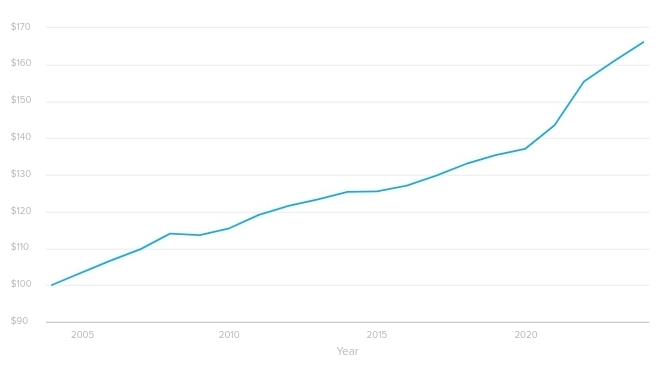

Speaking of the United States, $100 from 2004 would be worth roughly $166 today according to Smartasset inflation calculator.

Given these economic conditions, the development of an inflation-proof stablecoin positions itself as an innovation that would be vastly valuable to the consumer network and thus vastly adopted.

Traditional stablecoins are typically pegged to a fiat currency like the US dollar, but they do not account for the depreciation of purchasing power due to inflation. An inflation-proof stablecoin would need to adjust its value in response to real-time inflation data, preserving the purchasing power of its holders.

A system like this would revolutionize how people save money, knowing that it runs on a truly stable design that is borderless and void of government control. The permissionless nature of blockchains makes it the most suitable monetary layer for such innovation.

This could be achieved by pegging the stablecoin to a basket of goods and services that represent a broad measure of inflation, such as the Consumer Price Index (CPI).

Alternatively, it could be linked to a stable asset like gold, or utilize algorithmic mechanisms that automatically adjust the supply and/or trading price or liquidity provision incentives based on inflation rates reported by credible sources like the IMF or national statistics agencies.

By using reputable Oracle services like Chainlink, smart contracts can access off-chain data tracking scale that ensures the stablecoin maintains a truly inflation-proof trading price.

Such a stablecoin would provide a reliable store of value, especially in regions with volatile currencies or high inflation rates as aforementioned. It would cater to a vast consumer market seeking stability and protection against inflation, potentially revolutionizing financial solutions and offering a more resilient alternative to traditional fiat currencies amidst global economic uncertainties.

The Bottom Line

Having made significant technological strides in recent years, the focus within the crypto industry is increasingly shifting toward consumer crypto applications. Investors, users, business developers, and builders are now turning their attention to projects that can bring crypto to the masses.

One prominent example is TON Ventures, which is being led by key players within The Open Network (TON) ecosystem and is leveraging Telegram’s 900 million-strong user base. This initiative is poised to direct substantial investments toward applications designed to appeal to a broad consumer audience, aiming to onboard the next billion crypto users and further strengthen the overall ecosystem.

As liquidity continues to flow into the crypto and blockchain sectors from consumers and new investors eager to capitalize on this growth, the realization of a decentralized web—Web3—draws ever closer.

Please refer to linked texts or sentences for relevant sources of external data/information contained in this article.

Disclaimer: The content on this page and all pages of Icoverage.io are presented for informational purposes only and should not be considered finance or legal advice.

This page may contain affiliate promotions, see our affiliate disclosure to learn more.

Informations published are not financial advice see our terms of service

We use diverse first and third party softwares on our website, see our privacy-policy

If you found an error, misinformation, or something harmful or unusual on this page please report it now!

This page or pages of this website may contain affiliate links that earn us commissions when you use them at no additional cost to you, see our affiliate disclosure.

© ICPF All Rights Reserved

.gif?ts=1747849057)